Alula Technologies announces acquisition of employee benefits management platform

UK-based technology solutions firm for the insurance, healthcare, and pension fund industries, Alula Technologies, has acquired employee benefits platform, Ovation.

The deal will see Alula Technologies expand its international portfolio using Ovation’s secure cloud-based platform, allowing for the deployment and management of benefits from a range of providers.

The solution provides improved visibility and management of costs, centralised benefit processing and reporting for organisations, as well as ongoing engagement and financial education for employees.

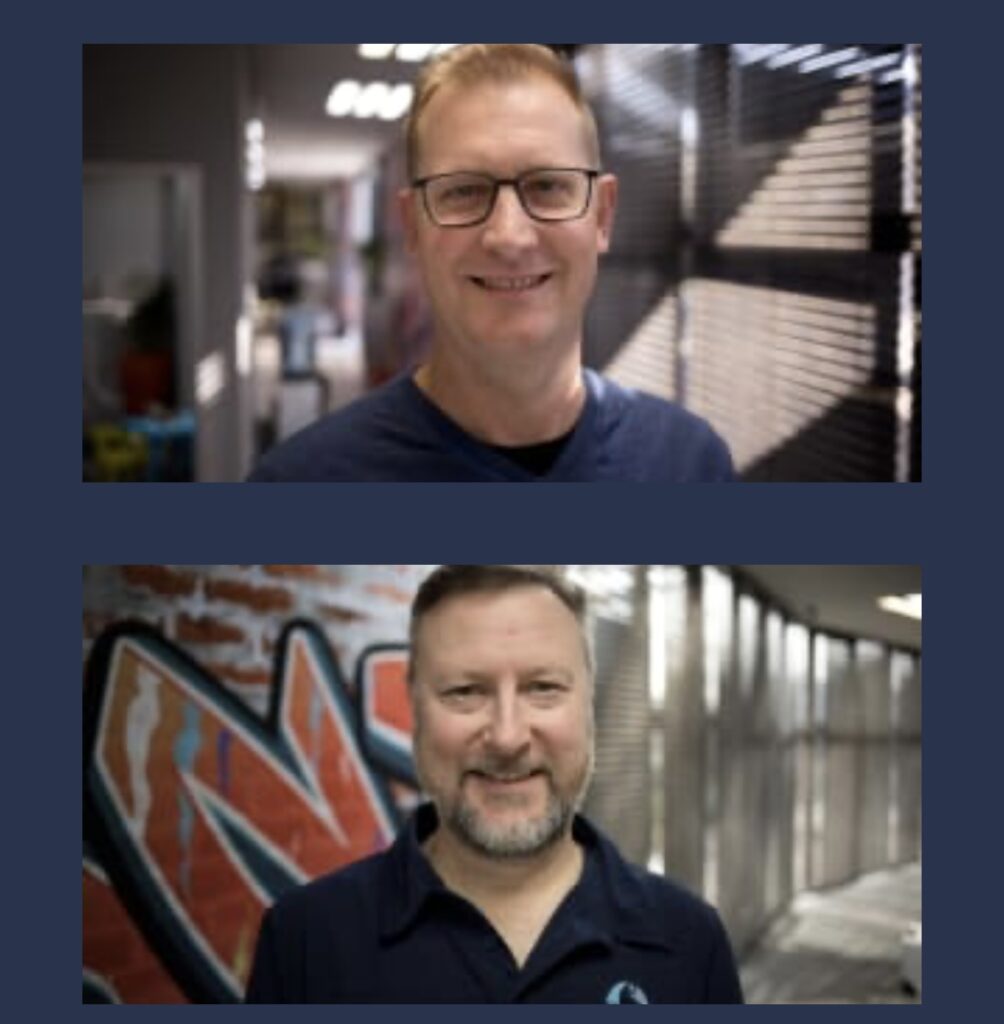

Alula Technologies CEO, Lee Kuyper, said:

‘Alula Technologies is continuing to enhance its position in the market by offering a comprehensive, end-to-end solution across the employee benefits vertical.’

‘This new, dynamic addition further enables Alula’s vision of revolutionising customer experiences in insurance, pensions and healthcare, not only for existing but also for new clients in our current markets and those that we have plans to expand into.’

Ovation, an established disruptor across the employee benefits management market within the Microsoft Azure ecosystem, has already been seamlessly integrated, with Alula Technologies’ staff and partners welcoming the move.

Lee added:

‘Integrating Ovation’s offering brings Alula’s clients into a new era of personalised, efficient and member-centric interactions that they can now offer members.’

‘Ovation’s core focus on member experience has provided Alula Technologies with the ‘missing piece’ in what will become a fully integrated end-to-end platform across insurance and pension funds.’

Calvin Mayo, CEO at Ovation Solutions – and formerly a key player at Microsoft – added:

‘From Ovation’s vantage point, the merger brings the security, credibility and exposure of Alula Technologies’ support structures and resources for long-term global expansion.’

‘The acquisition will further enable Ovation to fulfil their mission to empower their clients’ employees to be more than policy holders and pension contributors. They are also active participants in their own long-term financial journeys, not only within the African market but also globally.’

Calvin added:

‘Ovation’s addition to Alula’s technology stack bridges the gap between back-end administration and front-end engagement, as well as showcasing the relative maturity of the South African market on a global stage.’

Lee concluded:

‘As the digital revolution continues to change and improve industries across the globe, Alula Technologies’ expansion through this acquisition is transforming member engagement into a strategic competitive advantage for any business.’