UK UNDERPENSIONED GROUPS REACH RETIREMENT WITH PRIVATE PENSION INCOME LESS THAN TWO-THIRDS OF AVERAGE

now:pensions part of the Cardano Group, a business of Marsh McLennan (NYSE:MMC), today published The 2025 Underpensioned Report, in partnership with the Pensions Policy Institute (PPI).

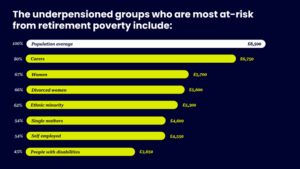

image003.pngMillions of people in the UK remain significantly underpensioned compared to the wider population. The latest data reveals that underpensioned groups have annual private pension incomes of between £3,650 and £6,750. This is compared to the population average of £8,500, leaving many individuals vulnerable to financial insecurity in retirement.

Since 2012, auto enrolment has transformed the way UK workers save for retirement and has brought more than 11 million additional people into a workplace pension scheme. However, many people in underpensioned groups do not meet the eligibility criteria for auto enrolment and miss out on the opportunity to save for their retirement.

Progress has been made in some areas, such as rising eligibility for auto enrolment, but the underpensioned challenge is far from resolved. As a consequence, these groups are forced to rely more heavily on the State Pension.

Fairer pensions for all

To help close the pension savings gap, now:pensions is proposing five key policy reforms:

Remove the £10,000 auto enrolment earnings trigger

Scrap the lower earnings limit on pension contributions

Introduce a family carer’s top-up

Ensure pension savings are considered in divorce settlements

Take greater action on childcare availability and costs

Carers and ethnic minority groups

People from ethnic minority backgrounds and carers are the groups that have seen an increase in employment rates and, consequently, pension savings since the 2022 report. However, despite the rise, these groups are still below the population average with 62% to 80% of total pension saving compared to the UK average.

People with disabilities

Of the underpensioned groups, people with disabilities have the lowest pension income at just 43% of the UK average, which means they have a private pension income of £3,650 compared to the population average of £8,500.

Women and single mothers

Women’s eligibility for auto enrolment has increased substantially since the inaugural report in 2020, rising from 77% in 2020 to 85% in 2025. Despite this progress, women are retiring with just 67% of the UK average and single mothers with just 54% of the UK average.

The self-employed

Pension income of the self-employed is 54% of the UK average population.

Joanne Segars, Chair of Trustees at now:pensions said: “Without further policy action, millions will continue to struggle to achieve a secure retirement. That’s why we’re suggesting key reforms, including removing the £10,000 auto enrolment earnings trigger, scrapping the lower earnings limit on pension contributions, and introducing a family carer’s top-up. These measures would help ensure that everyone, regardless of their working patterns or circumstances, has a fairer opportunity to build a financially secure future.”

John Adams, Senior Policy Analyst at the PPI and author of the report said: “While the rate of employment in the general population has fallen slightly since the previous report, under pensioned groups such as carers, single mothers and divorced women are particularly affected. Changes to automatic enrolment criteria could make huge strides in pension saving, such as allowing the income from multiple jobs combined to count toward the earnings trigger or removing the earnings trigger entirely.”