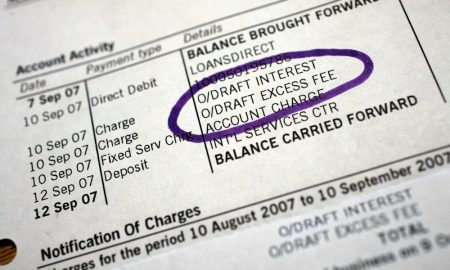

Banks and card issuers commit to ongoing support for consumer credit customers

The banking and finance industry has committed to renewed support for consumer credit customers facing financial difficulty as a result of the Covid-19 pandemic, as the Financial Conduct Authority (FCA) announces guidance which will come into effect on 25 November.

A total of 1.16 million payment deferrals on credit cards have been granted to customers with over 64,000 still in place, and over 814,000 payment deferrals on personal loans have so far been granted with over 31,000 still in place. Of those credit card and personal loan customers whose payment deferral has come to an end, evolving industry analysis suggests that three-quarters have now returned to making repayments.

The application window for customers to apply for a new payment deferral or to extend their payment deferral up to a maximum of six months in total has been extended until 31 March 2021. Customers on a payment deferral at 31 March 2021 are able to apply to extend their deferral for up to a further three months if they have not already taken the full six-month deferral. All deferrals will be completed by 31 July 2021 at the latest.

Consumers who have already had six months of payment deferrals or are receiving tailored support, will not be eligible for a further payment deferral under this scheme. For customers who are not eligible for a deferral, including if the lender believes a deferral is not in the customer’s interest, tailored support will be available.