Brits More Likely to Reveal Salary Than Admit to Getting Scammed

Brits are more likely to reveal how much they earn (27%) than admit to losing money in an online shopping scam (26%). New research released today from HSBC UK reveals, with almost one in ten (8%) victims of online shopping scams reported deliberately withholding their experience from friends and family.

£13.5 million was lost by victims of online shopping fraud last Christmas – and 73,000[iii] people fell victim to online shopping scams in 2019. With nearly two thirds (64%) of Brits planning to buy most of their Christmas presents online this year, and over a quarter (27%) of these people doing so for the first time, HSBC UK is calling for people to be vigilant to the risk of scams and alongside this research. The bank has created a guide to help consumers set up the ultimate scam safe shopping environment in their home and will also be hosting a scam survival bootcamp for the public.

The research also revealed that men proved to be the most secretive sex, with the research showing they are more likely to keep being a victim of an online shopping a secret from friends or family (9%), compared to women (6%).

The bank has partnered with criminologist and fraud expert Dr Elisabeth Carter to break down the secrecy surrounding online shopping scams and lift the lid on the secrets fraudsters are using to trick the UK out of their hard-earned cash, with the launch of a Scam Safe Guide and Scam Survival Bootcamp. The bootcamp will give the public the opportunity to speak directly with financial experts and fraud specialists, who will share methods to avoid shopping scams and what to look out for when shopping online this year.

Dr Elisabeth Carter, criminologist says: “Online fraudsters are active all year round, however in the run up to the festive season and with more people shopping online this year than ever before, they are all the more prevalent. It’s vital to stay alert when online shopping, as signs of a scam can be subtle, yet research shows that 70% of Brits multi-task whilst online shopping, with one in ten revealing they have shopped whilst in a Zoom meeting. Limiting distractions whilst online shopping lets you concentrate on spotting the key tricks of fraudsters and as such is one of the simplest ways to reduce the risk of becoming a scam victim. If you have been a victim of a scam, do not be ashamed, make sure you report it to Action Fraud.”

Ian Mason, Customer Experience Fraud Specialist at HSBC UK, said: “Fraudsters are increasingly sophisticated in their tactics, so we want people to understand there’s no shame if they become a victim of a scam. Instead we want to encourage people to share their personal stories with friends and families and help spread the word of what to look out for, so that we can work together to defeat the criminals who will go to extreme lengths to prise our hard-earned cash from us.”

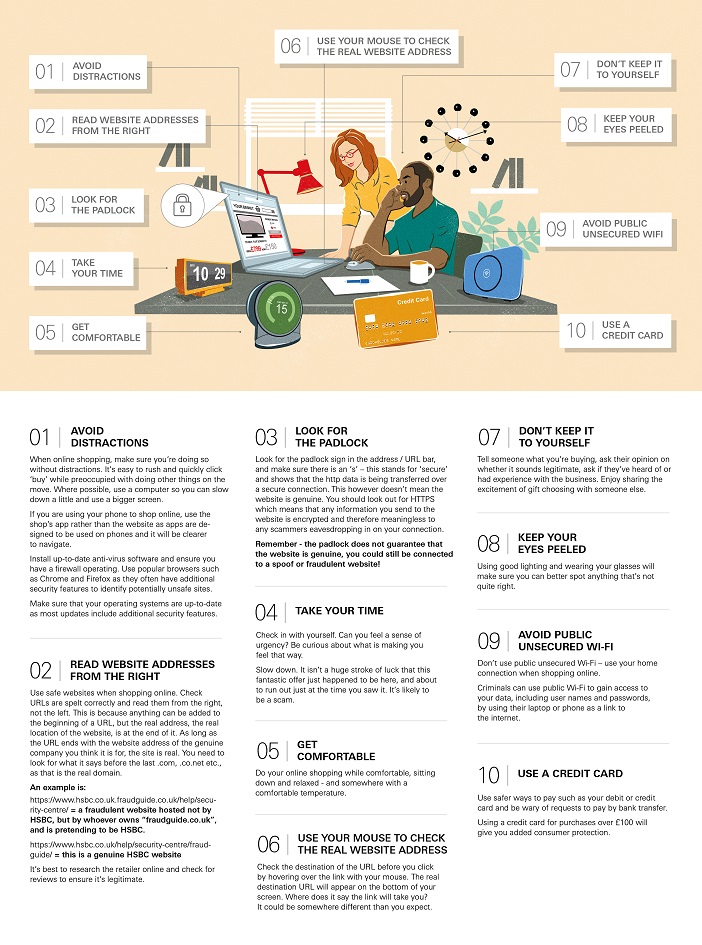

Top 5 tips to be Scam Safe:

Feeling the pressure? – Scammers will make you feel like you need to make a quick decision to purchase an item. Slow down and check whether you can feel a sense of urgency to avoid being caught out.

Read backwards! Anything can be added to the beginning of a URL, with genuine details always included at the end. So make sure you read URLS from the right, not the left.

Don’t forget to wear your glasses – Always check the small print and check you understand everything you’re agreeing to. Be especially careful when it comes to tick boxes by checking if the box means yes or no.

Use home WIFI where possible – Public WIFI is often unsecured making it more likely for scammers to strike. Save your online shopping for when you’re back at home.

Keep a credit card to hand – To keep your purchases protected this Christmas, use a credit card for purchases over £100 so you get added consumer protection.