CREDIT SCORE MYTHS: Half of Brits have never checked their credit score

Checking your credit score is one of the best ways to better understand your financial health. It can help steer you in the right direction when it comes to managing your finances, and help you become more aware of possible identity fraud. However, new research* has found that half of the UK public (49%) have never checked their credit score.

The research, from credit management company Lowell, found that many people in the UK are unaware of the importance of credit scores, what will and won’t affect their score, or how to check it.

Credit score ignorance

Checking your credit score is an important part of financial housekeeping, but a third of Brits (32%)[1] don’t know how to find out their credit score. 10% of people check their credit score just once a year, and just a quarter of people (24%) check their score once a month or more.

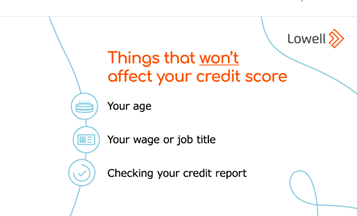

It’s not so surprising that people don’t like to check their credit scores often, as almost one in five people (17%) believe that the amount of times you check your credit score harms your credit.

Checking your own credit score is known as a ‘soft check’. The check will be noted on your file, but it won’t have an impact on your score. However, applying for new credit, like credit cards, loans, or finance agreements, will require a ‘hard check’ from the lender – and repeated applications, or having a lot in a short time, can decrease your credit score.

A fifth (21%) of Brits also believe that your job title and income can affect your credit score when this has no impact. 6% of people think borrowing money from friends and family makes a difference, even though this also has no impact.

What can affect your credit score?

There are lots of things that can have an impact on your credit score – but more than one in ten people (12%) don’t think that anything they do affects their credit score.

Three-quarters of Brits don’t believe that a phone contract can have an impact on your credit file (75%), and two-thirds (66%) don’t think that a car loan could affect your credit rating.

Also, almost half (45%) don’t believe missed payments affect your score when missing payments by 30 days or more can have a huge impact.

Two-thirds 66%) of respondents also didn’t think that store cards could affect your credit score. Having lots of credit agreements, like in-store finances or hire purchases, can lower your credit rating even if you’re making your repayments on time. When lenders decide whether they’re going to lend to you, they might look at your total credit and how many different lines of credit you have open to see your total repayments.