Debt Awareness Week: One in ten are having money issues because they won’t discuss their debt

With Debt Awareness Week running from the 20th March, credit management company Lowell has conducted a national study[1] to find the main causes of debt in the UK.

Currently, 13% of Brits confess that not discussing debt has resulted in money problems and one in ten (9%) say that their debt is caused by a lack of financial knowledge.

Worryingly, 32% of people in the UK[2] find it too uncomfortable to discuss finance issues, prompting Lowell to raise further debt awareness and to encourage people to talk and learn more about their money.

The research also determines the main causes of money problems and the detrimental effects it has on personal lives.

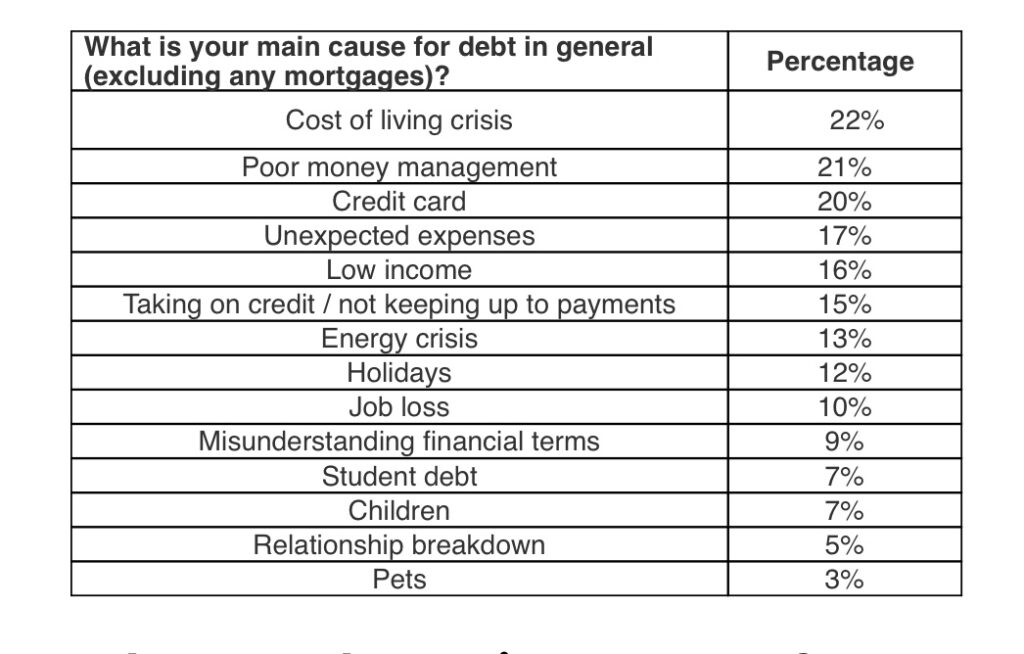

What are the main causes of debt specifically?

As well as one in five (22%) Brits claiming that the cost-of-living crisis is having an impact on them accumulating debt, 9% also confess a lack of financial knowledge is a big cause.

Poor money management (21%) is the second highest cause for debt, and worryingly, credit cards are responsible for one in five (20%) people’s debt.

In family life, children (7%) and pets (3%) are affecting borrowing around the UK and worryingly 10% are accruing debt because of the loss of a job.

What are the main causes of money problems and personal difficulties?

Currently, almost a third of Brits[2] are too uncomfortable to discuss money problems, which is having a detrimental effect on people’s personal lives. Talking about a financial situation could prevent some life changing situations such as relationship breakdowns and even divorce (14%).

In fact, although 37% have confessed that their financial difficulties are caused by unpredictable expenses, borrowing from a family member or loved one has also caused issues for one in three (33%) and disagreeing about how money is spent has also affected 12% of people’s relationships and financial situations.

Frivolous overspending (26%), and the cost-of-living crisis (20%) have also led to problems with keeping up with bills and debt payments (28%), and not discussing debt is also creating further financial issues (13%).

John Pears, UK Managing Director of Lowell UK said “At Lowell, we know the importance of talking about your finances.

The cost-of-living crisis is having a huge impact on many households, and in such an intense financial period, we want to ensure that people are as well-equipped as possible to handle and discuss their finances, so that they don’t have a heavy influence on accruing debt.

We want to help break down the stigma surrounding money and people asking for help because it’s very difficult to learn about money matters when you’re discouraged from talking about them.

We’d like to remind anyone looking to discuss their debt to seek out further support and information here, and to use Debt Awareness Week as a platform to make a change: https://www.lowell.co.uk/about-us/lowells-blog/wellbeing/time-to-talk/