FCA confirms guidance for insurance firms on assessing product value

The Financial Conduct Authority (FCA) is today confirming guidance for insurance firms to consider the impact of coronavirus (Covid-19) on the value of their insurance products.

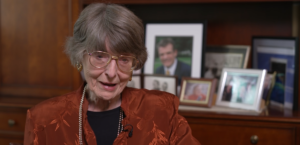

Sheldon Mills, Interim Executive Director of Strategy and Competition at the FCA, said:

‘Customers should expect value from the insurance products that they buy, but the exceptional circumstances of coronavirus may have materially reduced the value they are getting. Today’s guidance is designed to protect consumers by directing insurance firms to review the products they offer to ensure they provide appropriate value and take action where there has been a fundamental change in risk or where certain benefits can no longer be provided.

‘Firms may choose to go further than this guidance, and we recognise that some firms have already taken steps to support customers, which we welcome.’

The guidance sets out what the FCA considers firms should be doing to identify any material issues that affect the value of the general insurance and protection products they offer, and their ability to deliver good customer outcomes, during this unprecedented time.

The guidance sets out that firms should focus on reviewing products where benefits cannot be provided (e.g. boiler services due to lockdown measures) or where there has been a fundamental change in risk and products are now providing little or no utility to customers (e.g. public liability insurance for closed businesses).

The guidance is not intended to create an expectation that firms should reassess the value of insurance products where the likelihood of a customer making certain claims may have fallen, but the product continues to provide utility (e.g. motor insurance where, for example, theft or fire can still occur).

Firms should review their product lines and decide on any resulting actions within 6 months. This might include changing how benefits are delivered, refunding some premiums or suspending monthly payments for a certain period of time.

The FCA is now publishing its finalised guidance, subject to a small number of changes. This includes changes to clarify that firms:

- should consider the value of products where, due to the impact of coronavirus, there has been a material reduction in risk so that they are providing little or no utility to customers, and not just where claims are no longer possible

- are not expected under this guidance to assess value on an individual customer level, but should consider our guidance on helping customers in temporary financial difficulty as a result of coronavirus

- can assess the longer-term impacts of coronavirus on their insurance products on an ongoing basis beyond the 6-month period the FCA has set out for product reviews resulting from this guidance.

Today’s guidance comes into immediate effect and will be reviewed in 6 months in light of developments regarding coronavirus and may be revised if appropriate.

Customers who are struggling to afford their insurance or premium finance payments because of the impact of coronavirus should contact their insurer or insurance broker to discuss options. It is important people don’t leave themselves uninsured and should not hesitate to contact their insurer.