Half of Brits want urgent help managing their cash, new poll finds

Leading think tank launches Financial Education Initiative, backed by Lowell, to boost financial skills among the most disadvantaged.

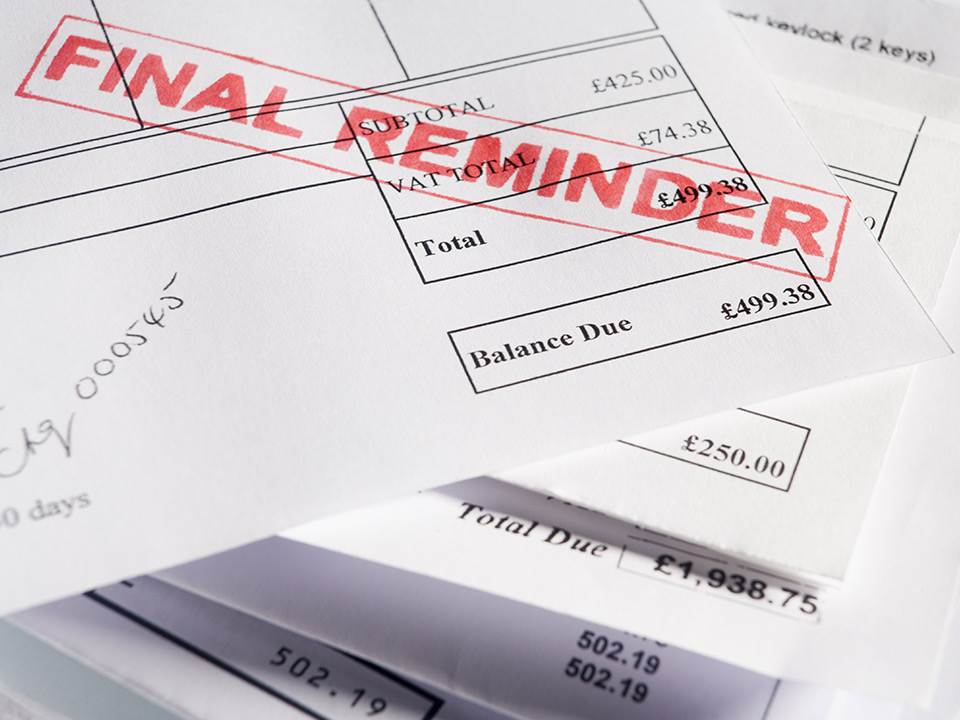

Nearly half of UK adults (44%) want urgent help in managing their own money, according to a new opinion poll highlighting the dire state of the personal finances of millions of people. They said that if they were better taught how to manage their household budgets and bills they would be in much better shape financially.

Problems are particularly acute among young people with two thirds (68%) saying a lack of money management skills is a key factor in driving them into debt.

So too are many people taking on new forms of debt with almost one in ten (9%) respondents saying they would use a Buy Now Pay Later product at Christmas, rising to one in five (17%) of 18-34 year olds. Half of all respondents (46 per cent) experiencing financial problems or having experienced them in the past said they attribute their financial woes to poor money management skills.

The findings come from a poll by Opinium of 4,000 people commissioned by the leading think-tank, the Centre for Social Justice (CSJ), and credit management company Lowell, who produce the UK’s first Financial Vulnerability Index. Recent research from the Government’s Money and Pensions Service also found that 24 million adults confessed to lacking confidence in managing their money.

With new financial products developing faster than they can be regulated, many struggling to manage their finances and financial vulnerability rising in the UK[1], financial education is urgently needed at more touch points across a person’s financial lifespan.

The CSJ and Lowell are joining forces to reduce levels of financial illiteracy and improve the support for people on low-incomes facing a rapidly changing financial market and cost of living crisis.

They have launched the Financial Education Initiative: a research and policy programme that will gather data about the changing financial landscape, examining levels of financial literacy, reviewing the current financial education offer and making recommendations on where action can be taken.

Robert Halfon MP, Chair of the Education Select Committee, said:

“The growing cost of living crisis means that families are under huge pressure to ensure every pound goes the extra mile.

“Financial education must be seen as a core element of the Skills agenda and must be firmly embedded in our education system. Building these skills to support the development of an apprenticeship nation must work in tandem with transforming our national curriculum to better prepare pupils for the future world of work.

“This is why I welcome the Financial Education Initiative launched by the Centre for Social Justice and Lowell today and await their findings with interest.”

John Pears, UK CEO of Lowell, said: “Every day we see people in vulnerable situations due to a lack of ability to manage their finances. With so many pressures on households with the rising cost of living and financial vulnerability in the UK, we want to get to the root of the problem and help people better manage their money. That means understanding what is going wrong, understanding why people aren’t getting the education and support they need. I am looking forward to seeing the results of the initiative and supporting the team at the CSJ campaign for action in the public and private sector.”

Andy Cook, CEO of the Centre for Social Justice, said: “It’s clear from our research that money management skills have a huge role to play in helping people, particularly those on low-incomes and young people, navigate their way through the cost of living crisis. We are delighted to be partnering with Lowell on this vital project to improve the nation’s financial literacy.”

The partnership will culminate with a report containing a suite of policy recommendations set for release in May of 2022. The CSJ is today launching a Call for Evidence from agencies, organisations, and individuals who have experience of delivering financial education, as well as those with an interest in reshaping how the Government tackles the issue of low financial literacy. The deadline for submissions is Friday 11th February 2022. Further details on how to submit evidence are available at www.centreforsocialjustice.org.uk