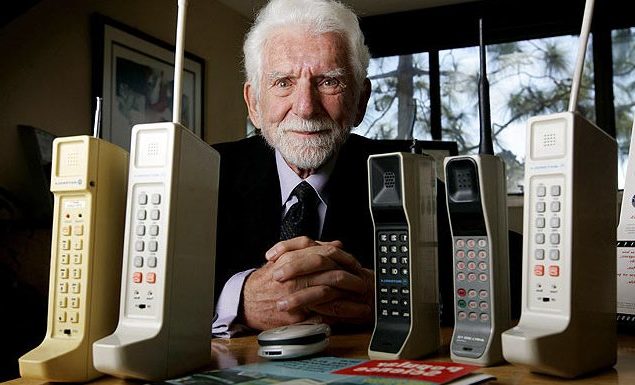

How the mobile phone changed the face of retail – in just 50 years

In April 2023, the mobile phone will turn 50. In just half a century, the way we work, communicate, bank and shop, have changed thanks to this piece of technology.

Within the retail sphere, this Christmas season alone, shops are expected to increase their revenues by as much as 20% – but how much of this increase can be attributed to e-commerce and mobile shopping habits? Dr Dinara Davlembayeva, Lecturer in Marketing at Kent Business School, University of Kent, comments on the rise of mobile commerce:

‘For the past three years, the undeniable trend set by the pandemic has been the change in consumer behaviour toward online shopping. Compared to the pre-pandemic period when the percentage of the population buying online was around 75%, in 2022 it has made around 87%, and it is projected to reach 90% by 2025.

‘The primary platform has been mobile devices. Against the backdrop of market changes, the retail spending of the UK population over the Christmas period will likely match the general trend that has been defined by the previous three years, even though consumers are no longer constrained by social distancing restrictions. Compared to 2019, sales in stores are expected to shrink by 15%, while online sales are expected to grow by 27%. Given the forecasts, the embeddedness of mobile devices in the customer shopping journey is likely to sustain and grow in the years to come.

‘Mobile technology offers affordances enabling brands to make the shopping experience personalised, efficient, and entertaining. Leveraging access to customers’ behavioural data online, brands can increase the potential conversion rate using real-time hyper-targeted ads and messages. Voice and visual search features integrated into websites and apps make the customer journey easier and faster.

‘Owing to the pandemic, social networking apps, primarily, Tiktok, have found growing marketing application as it appeals to the audience seeking to reconcile the experiences of social interaction, shopping, and entertainment on a single platform. The platform is particularly popular among Gen Z customers, who are prone to making unplanned purchases while discovering content. 88% of TikTok users discover new products and services while using mobile apps. Out of those, 91% react to that content, 25% look for more information or purchase the advertised products and services, and 73% provide recommendations to their family and friends.

‘Global online companies and smaller independent shops have managed to capitalise on the ubiquity of mobile technology the most. E-commerce companies, such as Amazon and Asos, have all the necessary infrastructure in place to capitalise on mobile technology but smaller, independent shops embraced the benefits of higher exposure through the internet by trading their goods on global online marketplaces as third-party sellers. Third-party online marketplaces are forecasted to grow and comprise nearly two-thirds of the global market by 2027.

‘However, the behavioural implications of the pandemic have been more difficult to bear for big brick-and-mortar stores with multiple offline locations. As such, we have seen the closure of iconic department stores and retail chains since 2020. Although the difficulty to adapt the business models to fit the digital landscape may have not been the only reason why those brands have failed, it has greatly contributed.

‘On a positive note, online retailers will never be able to completely replace the offline purchase experience. There are many trends that point to that. First, mobile and social commerce in particular is primarily for Gen Z and Millennials, who engage the most in purchasing, browsing, and discovering products via social media platforms. For brands catering to wide generational segments, it is important to offer a combination of channels to interact with.

‘Second, there is a growing segment of the population, who shop on the go. They browse in physical stores while making half of their actual purchases online. The higher sale conversion for such audiences can be achieved by using QR codes, which have been used by brands, such as Ralph Lauren and Lacoste, to enable instant online purchases and access to brand information and offerings at physical touchpoints.

‘Third, preferences for mobile purchase channels vary across product categories. For example, top mobile spending sectors include clothing, food/grocery shopping, and health and beauty products, while furniture, goods for kids, and electronics are the least purchased categories.

‘Finally, due to increasing accessibility to product information and market transparency, customers value the ease of transition between online and offline channels. The omnichannel experience reflects the consistency and relevance of information across all touchpoints in the purchase journey – i.e. physical stores, call centers, web chat, and third-party marketplace. Therefore, the key to retail success in the post-pandemic era may lie in prioritising online offerings without excluding high street presence to ensure a seamless customer experience across multiple channels.’

Dr Dinara Davlembayeva is a Lecturer in Marketing at Kent Business School, University of Kent. Dinara’s research reflects interests in theories explaining individuals’ behaviour and purchase decisions within digitally mediated environments and social groups.