New overdraft rules mean 7 out of 10 people will be better off or see no change

Across the market, 7 out of 10 overdraft users will be better off or see no change when new rules on overdrafts, introduced by the Financial Conduct Authority (FCA), come into force in April.

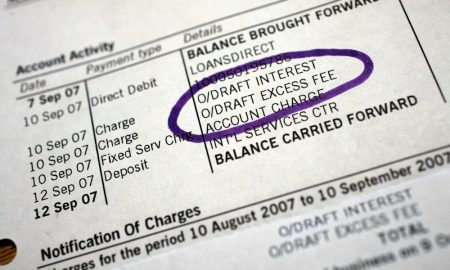

Around 14 million people use an unarranged overdraft each year, and all of these users will be better off or see no change. The FCA’s work highlighted that unarranged overdraft prices were regularly 10 times – and for some consumers as much as 20 times – as high as for payday loans. Customers at some large banks were charged effective arranged overdraft rates in excess of 80% per year once fees and charges are factored in.

The cost of borrowing £100 through an unarranged overdraft is expected to drop from a typical £5 per day to under 10p per day. For an unarranged overdraft user borrowing £100 for 7 days the changes to the market could see them better off by as much as £55.35 a month. Those who use their arranged overdraft to borrow smaller amounts, are more likely to be better off. Some borrowers who use their arranged overdraft to borrow larger sums can now see the true cost of borrowing. Where prices have increased, the FCA encourages people to shop around and consider using cheaper forms of borrowing, such as a 0% credit card, other credit card or alternative products.

Firms must now charge a simple annual interest rate – without additional fees and charges for using an overdraft. This means that while headline interest rates have increased, the cost of borrowing has gone down or remained unchanged for most people. It will also be easier for everyone to understand what they’re paying, and to compare overdrafts between different providers and different forms of credit. FCA research previously found that 4 out of 5 overdraft users couldn’t work out which of a range of overdraft models was the cheapest.

Christopher Woolard, Executive Director of Strategy and Competition at the FCA, said: ‘Our changes expose the true cost of an overdraft. We have eliminated high prices for unarranged overdrafts. This will result in a fairer distribution of charges, helping vulnerable consumers, who were disproportionately hit by high unarranged overdraft charges, and many people who use their overdraft from time-to-time.

‘7 out of 10 overdraft users will be better off or see no change. At two banks that figure is 9 out of 10. Consumers can now see how expensive overdrafts really are. Those who are worse off should consider shopping around to find a cheaper deal. Credit and other forms of borrowing can be significantly cheaper for long-term users.’