New study reveals how COVID-19 is affecting retirement savings

Saving for your retirement is an important aspect of financial planning. If you plan on living out your retirement years comfortably and without any nasty surprises, then saving is a must.

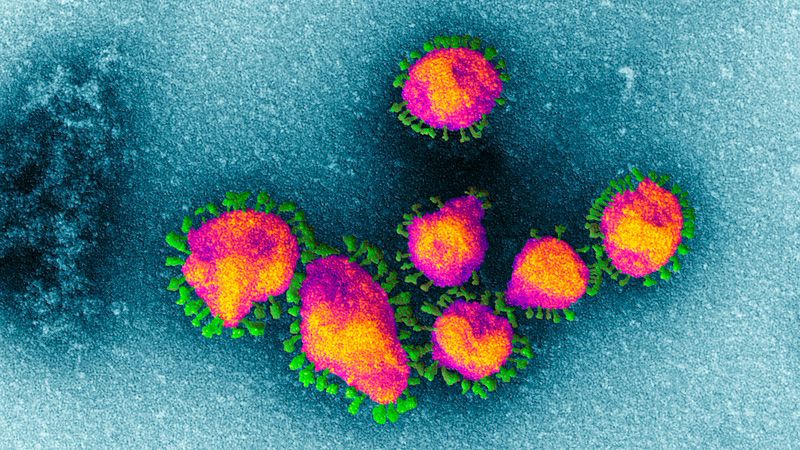

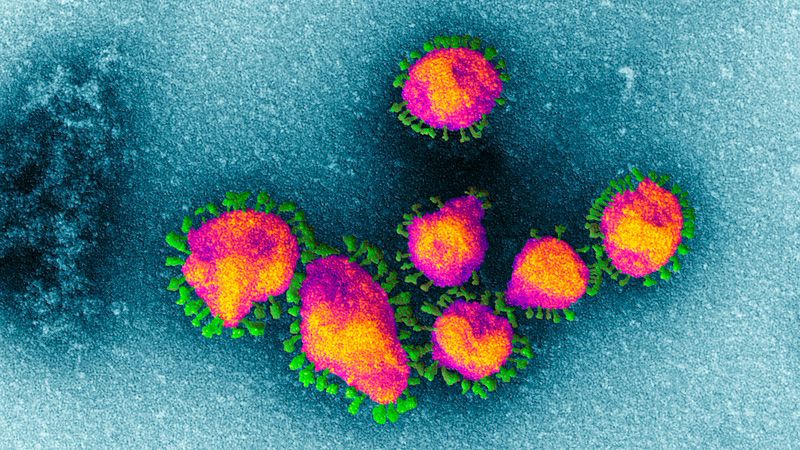

But currently, the coronavirus outbreak has hit all aspects of our lives, with many Brits concerned about their jobs, outgoings, debts, retirement and many other financial impacts. With seven in ten Brits fearing for their finances1, and as the epidemic worsens, it is set to have long-term effects on personal finances.

The latest figures by Blacktower Financial Management Group show that you need to save £375,676 to retire comfortably on an income of £26,834 per year. But, which areas in the UK are saving the most, and how is COVID-19 impacting retirement savings?

COVID-19 impact on retirement savings

COVID-19 is having a big impact on global financial markets, and this can be hard to watch if the value of your personal savings is falling. This is causing fear and uncertainty amongst Britons, as we don’t know what the lasting impact will be. But it’s important to remember that pensions are a long-term investment, and it’s normal for the value of investments to move as the economy goes through phases of fluctuation. History has shown us that values go up in the long-term, despite short-term ups and downs.

Pensions are normally mixed in several assets such as bonds and commodities, to spread the risk and reduce impact. The UK government bonds have seen a positive return over this unsettling period due to a rise in demand. Pensions are a long-term investment, so it’s important to look beyond the disruption.

The best way to boost your pension during the pandemic is to try and make monthly payment contributions, even if you pay a smaller amount for the time being.

“The earlier you adopt the practice of saving and investing on a regular basis, the less painful it will be on your bank account as the years go by”

– Luke David Hunt, Associated Director, Blacktower Financial Management Group

If you’re thinking of switching investments or taking money out of your pension pot, it is recommended that you speak to an experienced financial advisor as making drastic decisions in the short term can be a risky thing to do. Speak to an advisor who can help make your investments safe and stretch further.

London is the top city for retirement saving

London is known to be the most expensive city in the UK, but surprisingly it is the UK city where the highest percentage of residents have hit the correct amount of £375,676 for retirement – although that’s just 14%.