Personal-tax expert shares tips on how Brits can offset their energy bills

New data reveals that Brits who work from home are set to fork out an additional £131 a month on energy bills; this is set to go up even more, with news that the treasury is considering raising the energy price cap from April. The same study also found that daily gas bills are set to increase by 75% for full-time home workers, while the average cost per usage for electricity is set to rise by 25%. According to the Office of National Statistics (ONS), half of the UK’s workforce worked remotely during the pandemic and 84% of those who began working from home during lockdown plan to continue, meaning our homes could soon become costly workspaces.

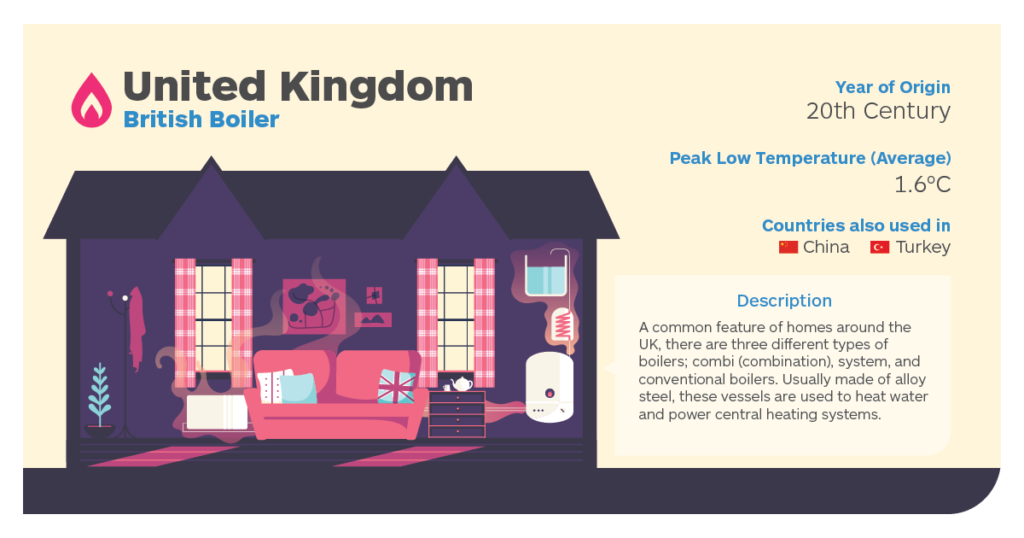

In light of this, Tommy Mcnally, tax expert and CEO of the UK’s leading tax-refund app, Tommys Tax, explains how workers can potentially claw back tax relief to offset the energy bill burden when working from home. Mcnally explains that at the new price cap, an 8-hour day of working from home could cost more than £30 a day – excluding services such as broadband connections. The main costs would be heating, which can cost £3.60 an hour to run, while a 32kW boiler will cost £4.80 an hour. For electricity costs, a desktop PC and monitor will cost £1.25 a day to run for eight hours.

Claim a flat rate tax relief:

You can claim tax relief on £6 a week for energy prices and other costs related to working at home. In order to claim this, you must be required to work from home, so this only applies if your employer doesn’t have an office or if this is written in your contract. If you’re claiming a flat rate, you don’t need to keep receipts.

Claim actual costs:

You can claim tax relief on the actual costs of working from home. To do this, you will have to keep your receipts for utility bills such as gas, electricity and internet, and identify how much was used while working at home. While this method is a little more laborious, it also means a larger amount can be claimed back.

Ask your employer for help:

It’s up to your employer if they want to make payments for additional costs incurred when you’re working at home – however, these payments are tax-exempt which could encourage your employer even more. If you don’t receive any compensation at all, it’s probably worth asking them about it.

Tommy Mcnally, leading tax expert and CEO of Tommys Tax comments:

“With nearly everyone impacted by the increasing cost of living across the board, there are ways in which people can inject a much-needed boost into their bank accounts. One of these ways is the many tax rebates that people are eligible for, but don’t make use of and that is where we’re here to help. Taxes can be boring, confusing and anxiety-inducing, but if done right could make a real difference to people’s lives.”