Sellers turn to tech for lower cost property surveys

The cost of selling a home is an important consideration for property owners looking to move, particularly when house prices are falling. Rightmove’s data so far this month shows the first June fall in property prices for a decade, with a drop of 0.3%. The fall follows a 0.4% month-on-month price drop in May, according to Halifax’s figures.

Meanwhile, the HomeOwners Alliance estimates that the cost of selling an average UK home (priced at £290,000) comes in at £4,910. The estimate includes £4,150 in estate agency fees, £700 for conveyancing and £60 for the property’s Energy Performance Certificate.

This estimated selling cost assumes that everything runs smoothly. However, unexpected survey results can often disrupt the sales process, leading to everything from last-minute renegotiations to additional legal fees.

Some sellers pay for a property survey to be done to ensure they’re aware of any potential issues earlier on during the sales process, but the cost – between £300 and £1,500 according to RICS – prevents many from doing so. Instead, they leave the survey to the buyer, meaning it takes place at a much later (and potentially much more disruptive) stage in the process.

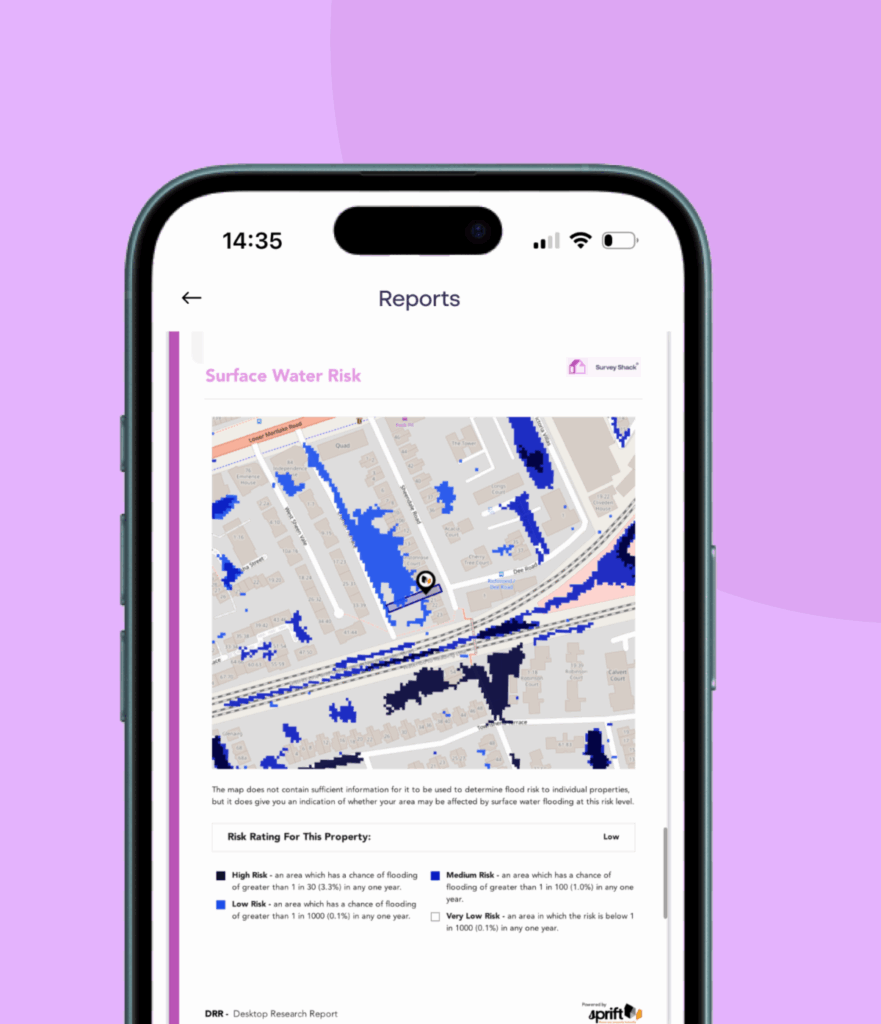

Now, though, advances in technology are presenting sellers with an alternative. The Survey Shack app, launched in October 2024 and already downloaded over 1,000 times, is providing sellers with a DIY survey option. The app enables sellers to uncover valuable, surveyor-inspired insights about their property’s condition, enabling them to make informed decisions with confidence.

Founded by qualified surveyors, Survey Shack delivers critical property data, guiding the seller through a free property inspection with easy-to-follow instructions. The seller can then purchase an instant report, packed with tailored, actionable insights for just £29.99.

Survey Shack’s use of technology to ease issues with UK property sales is aligned with the government’s plans to digitise and modernise the entire buying and selling process. The government announced in February 2025 that it aims to tackle the high rate of property transactions falling through, which impacts one in three property transactions in the UK. This is estimated to cost people around £400 million per year, along with another £1 billion for the four million working days that conveyancers and estate agents lost to collapsing transactions.