Simply Loft can make your dream come true with their new financial scheme

Whether you have outgrown your family home or long for more space, Simply Loft can make your dream come true with their new financial scheme.

Simply Loft, the leading builder of loft conversions across London and the Midlands, have announced they are now a registered Financial Conduct Authority (FCA) credit broker.

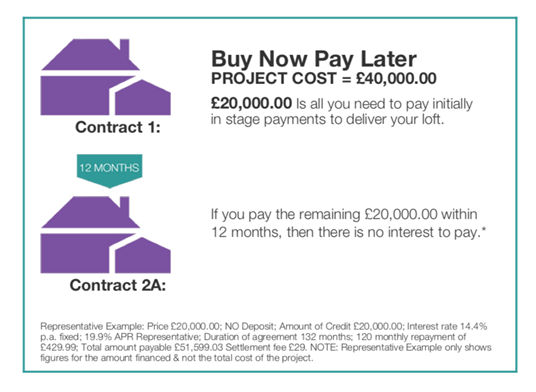

For their customers, this means they can now spread the cost of half of their new loft conversion with one of Simply Loft’s two financial schemes. To date, those looking to expand their family home have habitually relied upon the onerous re-mortgaging of their property.

Robert Wood, director of Simply Loft, said: “Re-mortgaging a property to pay for a loft conversion can bring about all sorts of issues, including the time delay needed to process a new mortgage or drawdown funds, plus the penalties which are invariably incurred. Our new financial schemes allow our customers to choose between two payment options which are much faster, simpler and fit better with their family budgeting.”

He added: “Simply Loft have gone through the very stringent and strict vetting process to become approved and regulated by the FCA. For our customers, this means the important elements of our loft conversions such as the loft structure, cladding and water-proofing, will be fully insured by the FCA. We believe this is vital when considering undertaking any home building works and are delighted that this alone sets us apart from other similar building firms. We will also be working with customers to ensure they get a fast response to their finance applications. Typically, we can agree on a new agreement within four hours, which is a huge benefit when compared to re-mortgage applications which tend to take six to eight weeks.