The GBP Sterling after the Decision of the Bank of England: Expectations and Challenges

The GBP Sterling after the Decision of the Bank of England: Expectations and Challenges

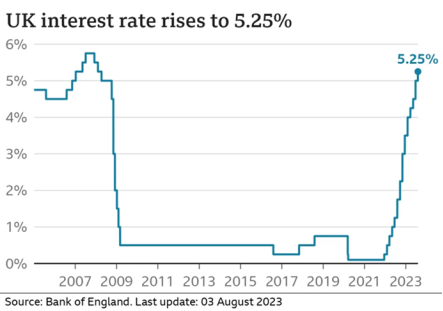

The GBP Sterling has slightly declined at the beginning of Thursday’s trading, down by 1.26% for the week. Shortly ago, the Bank of England’s meeting concluded, and as expected, they raised interest rates by 25 basis points. This marks the 13th consecutive interest rate hike since December 2021, and it is widely anticipated that rates will continue to rise in their upcoming meetings.

Following today’s announcement, the Bank of England, for the first time, explicitly stated that interest rates would remain higher for a longer period in an attempt to combat surging inflation. The bank also revealed plans to curb rising living costs, raising the final interest rates again to 5.25% from 5%.

Currently, British interest rates have reached their highest levels in 15 years, which will translate to higher mortgage and loan payments but is expected to result in higher savings rates as well. The bank was more cautious about the UK’s economic growth but confirmed that the country would avoid a recession.

During the subsequent press conference on Thursday’s decision, officials indicated for the first time that it is necessary to keep interest rates at their elevated levels until inflation in the UK is under control. However, they did not specify the duration it would take.

Andrew Bailey, the Governor of the Bank of England, said, “We know inflation hits the least wealthy citizens, and we need to be sure that it comes down consistently to reach the 2% target.” He added that the bank expects inflation to fall to 1.7% within two years, but there are still significant risks surrounding those projections, potentially leading to a slight increase in these rates.

In conclusion, much of what will happen to inflation in the coming years will depend primarily on the labor market and wage data, especially after private sector salary data in the UK exceeded expectations in recent months, supporting the strength of the GBP Sterling in the medium and long term.

British officials foresee the impact of interest rate hikes starting to affect citizens and the economy at the beginning of next year if the growth remains slower than in pre-COVID times.

A growing economy means more jobs and more profitable companies that can pay employees and shareholders more, which, in my opinion, will provide the government with more tax revenue.

It is worth mentioning that the rise in food prices has been one of the major contributing factors to the inflation surge, but the bank stated that there is evidence of this increase gradually slowing down. The bank also added that corporate profits have not changed significantly over the past two years, indicating that companies raising prices to increase their profit margins are not currently a significant contributor to inflation.

Based on the foregoing, the minutes of this month’s meeting revealed a three-way split among the members of the Monetary Policy Committee of the Bank of England regarding the direction of interest rates. Among its nine members, six voted, including the governor, to maintain the rates at 5.25%. In contrast, only two voted for a stronger increase to 5.5%, while the remaining member voted to keep the interest rates at 5%. This could put pressure on Sterling’s trading in the short and medium term, as it did not respond strongly to today’s interest rate hike decision.

Technically, the GBP Sterling remained low against the dollar even with the central bank’s decision today and showed no significant response, only experiencing a slight increase in the last few minutes to reach 1.268 dollars in an attempt to break out of the current oversold area on the daily chart. This aligns with technical momentum indicators suggesting the possibility of an upward reversal in Sterling’s trading in the near and medium term.