The UK’s Commanding Role in Global Currency Trading

Imagine a world where currency is not just a medium for buying your morning coffee, but a pulsating, dynamic market, where fortunes can be made and strategies are king. Welcome to the world of Forex trading, where the UK stands as a colossal player on this global stage. In this vast sea of currency exchange, understanding how to start trading forex online is your first step towards mastering the tides. Let’s dive into the intricate dance of numbers and trends that position the UK as a titan in the Forex arena.

Table 1: UK Forex Market Key Statistics

|

Statistic |

Value |

|

UK’s Global Share of Forex Trading |

38.1% |

|

Daily Forex Turnover in the UK |

$2.86 trillion (approx.) |

|

Equity Market Capitalisation to GDP |

108.6% |

The UK’s Financial Market at a Glance

Beyond the iconic Big Ben and the historical allure of its streets, the UK hides another powerhouse: its financial market. Boasting a staggering £81bn trade surplus in financial and related professional services, this island nation punches well above its weight. The London Stock Exchange, a beacon of global finance, witnesses daily challenges of trading in stocks, commodities, indices and forex, with 333 foreign companies listed as of September 2022, echoing London’s international allure.

The Forex Market in the UK – A Titan’s Playground

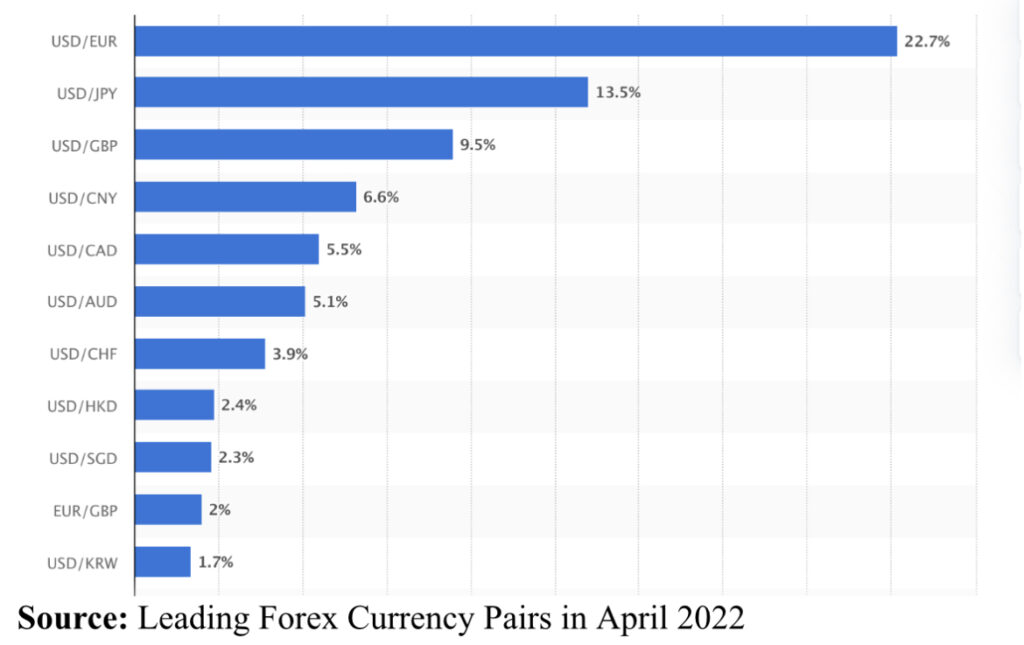

In the realm of Forex, the UK is more than just a player; it’s a conductor orchestrating a symphony of currencies. With an astonishing 38% of the global foreign exchange turnover, the UK’s Forex market is a bustling hub, dwarfing even the US in its sheer volume of US dollars traded. Here, pounds and dollars, euros and yen, all dance to the rhythm of supply and demand, influenced by the ever-changing global economic landscape.

Table 2: Comparative Analysis of UK and Global Forex Markets

|

Aspect |

UK |

Global |

|

Daily Forex Turnover |

$2.86 trillion (approx.) |

Variable |

|

Number of Active Forex Traders |

Hundreds of thousands |

Millions |

|

Major Trading Currencies |

GBP, USD, EUR |

USD, EUR, JPY, GBP |

The Impact of Global Events on UK’s Forex Market

From the tumultuous waves of Brexit to the unpredictable winds of the COVID-19 pandemic, global events have left their mark on the UK’s Forex market. Each international incident and policy change sends ripples across the market, affecting strategies and outcomes. Traders in the UK, equipped with resilience and adaptability, navigate these waters, constantly adjusting their sails to the changing winds of global finance.

The Future of Forex Trading in the UK

What does the future hold for the UK’s Forex market? As technology advances, bringing forth sophisticated trading platforms and AI-driven analytics, the UK’s Forex market is poised for even greater heights. The integration of fintech innovations and the growth of sustainable and Islamic banking are not just trends but signposts towards a more diversified and dynamic trading environment.

London – The Epicenter of International Financial Markets![]() Source: BIS Triennial Central Bank Survey

Source: BIS Triennial Central Bank Survey

As we traverse the landscape of the UK’s financial markets, it becomes clear that London is not just the heart of Forex trading; it’s the pulsating core of diverse financial activities. The city’s prowess extends beyond currencies into the realms of insurance, international banking, and investment banking, making it a global financial powerhouse.

Beyond Currency – UK Financials Dominate

The UK’s insurance industry, the largest in Europe and the fourth largest globally boasts about $399bn (£291bn) in premiums as of 2021. It’s not just the size but the diversity of this sector that astounds – from the traditional London Market to the innovative Lloyd’s Market, the sector is a kaleidoscope of financial ingenuity and resilience. This is underscored by the UK’s role as the largest source of pension funds in Europe, with a staggering $3.9 trillion (£2.8 trillion) under management.

Table 3: The UK’s Position in Global Insurance

|

Indicator |

UK’s Position |

|

Premiums (2021) |

$399bn (£291bn) |

|

Pension Funds (2021) |

$3.9trn (£2.8trn) |

|

Insurance Funds (2020) |

$2trn (£1.6trn) |

International Banking: A Global Leader

In the arena of international bank lending and borrowing, the UK’s presence is formidable. With a 15% share in lending and 17% in borrowing as of Q2 2022, the UK demonstrates not just financial strength but also a strategic position in global finance. This is a market where giants like France, Japan, and Germany play, yet the UK consistently emerges as a leader.

Private and Investment Banking: London’s Crown Jewels

London’s significance in private and investment banking is undeniable. Home to giants such as Bank of America, Credit Suisse, and Goldman Sachs, London is a magnet for global banking activities. The city’s dominance is further highlighted in its leading role in foreign exchange trading, where it accounted for a whopping 38% of global trading in April 2022.

Table 4: London’s Stature in International Banking

|

Aspect |

UK’s Contribution |

|

Foreign Exchange Trading (2022) |

38% of global total |

|

International Bank Lending (2022) |

15% |

|

International Bank Borrowing (2022) |

17% |

The UK, with London at its helm, is more than a financial hub; it’s a symphony of economic power and innovation. From the roaring trade of Forex to its commanding presence in insurance and banking, the UK’s financial markets are a testament to its global influence and expertise. As the world evolves, so too does the UK’s role in shaping the future of international finance.