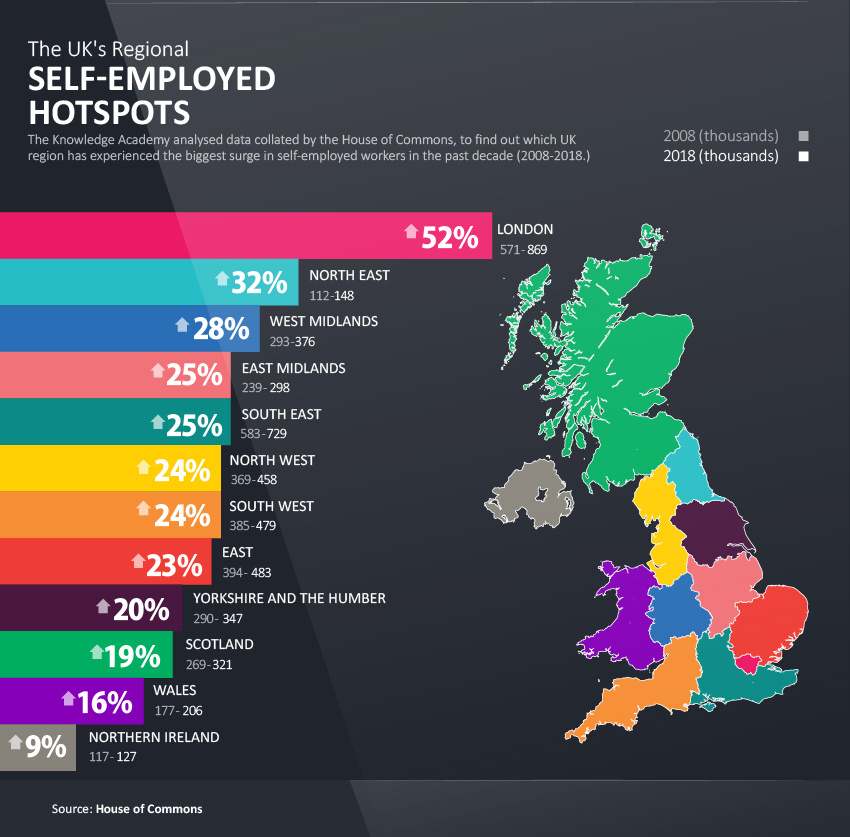

The UK’s Regional Self-Employed Hotspots

- 67% of Brits are thinking about quitting their jobs to go freelance.

- London has seen the largest surge in self-employed workers in the last 10 years.

- The North East has seen freelance workers grow by over a THIRD in the last decade.

- Northern Ireland has seen the smallest surge in self-employed workers in the last decade.

Per a recent article posted on yourmoney.com, over two-thirds (67%) of Brits are thinking about quitting their jobs to go freelance; with flexible hours, being your own boss and working wherever you want cited as the top perks.

This inspired education and training providers theknowledgeacademy.com to explore how self-employment has changed in the last decade.

To achieve the figures, The Knowledge Academy analysed data (to include numbers and percentages) in the report Labour Market Statistics: UK Regions and Countries* by the House of Commons.

Self-employment datasets from 2008 and 2018 were compared, before the overall percentage change was calculated. This enabled The Knowledge Academy to identify the UK region that has experienced the biggest surge in self-employed workers in the past decade.

The Findings

In terms of self-employment numbers, significant increases have been seen in London, the North East and West Midlands in the period 2008 to 2018 (52%, 32% and 28% respectively.)

It may come as no surprise that London has seen the largest surge in self-employed workers, growing from 571,000 (15.1%) in 2008 to 869,000 (18.8%) in 2018; a percentage change of 52%.

Comparably, smaller increases in self-employment numbers have been seen in Yorkshire and The Humber, Scotland and Wales in the period 2008 to 2018 (20%, 19% and 16% respectively.)

Wales has seen one of the smallest increases in self-employed workers, growing from 177,000 (13.1%) in 2008 to 206,000 (14.1%) in 2018; a percentage change of 16%.

Northern Ireland has seen the smallest surge in self-employed workers in the last decade. In 2008, 117,000 (14.7%) of workers in Northern Ireland were self-employed; in 2018, this rose to 127,000 (14.9%) – a percentage change of just 9%.

Thinking of becoming self-employed?

- Get Experience

If it’s an option for you, try contract work at agencies to build your portfolio and CV. This will help you to learn and engage with the right people. Or, if it’s a better fit, try gaining experience and building connections by providing your service for free, or at a discounted rate. This isn’t for everyone but, whichever way you choose to gain experience, it’s invaluable – just remember to set clear boundaries from the start.

- Research Your Business Idea

The key to this is understanding your competition. Who are they? Where are they based? What do they offer their key demographic? How will your business compare? In thoroughly researching your business idea, you will create a watertight marketing plan. You will understand how to win customers, how to advertise and promote accordingly and you will be able to envision a sales forecast that will inform all the above.

- Network

Networking serves so much purpose to the self-employed. It’s the only way to build a client base, promote your business and brand, and stave off some of the loneliness that comes from solo working. Perhaps join unions, small business communities and groups on social media, which you can utilise for advice, technical learning and support.

- Save

Self-employment can come with ebb and flow, especially when it comes to money. It might be worth setting aside a reserve or emergency fund if you are thinking of becoming freelance. The idea is to have funds to draw from if business is slow. To start, calculate your average monthly expenses. Whenever your income exceeds these expenses, simply save the surplus. Alternately, you can save a percentage of every payment. When you earn more, you save more. When you earn less, you save less. A style that suits a fluctuating income.