UK Survey Results Highlight The Divided Viewpoint On The Future For The Post-Brexit Economy

Recent survey results published by Money Transfer Comparison highlight a very fractured outlook for the United Kingdom’s economy amongst respondents as the extended April 12th deadline for the British exit from the European Union approaches. The survey, which collected responses from 2,552 British citizens, underscores the highly divergent views for the economic outlook amongst respondents.

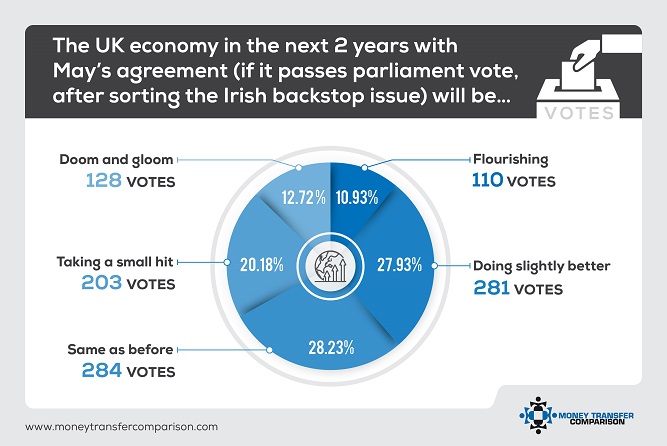

Data collected by research analytics firm Corus uncovered the following:

-Only 11% of respondents who voted “Leave” in the referendum believe the UK economy will flourish during the 2 years following Brexit, while less than 7% of all respondents believe that will be the case

-Over 60% of respondents surveyed who voted to “Leave” believe the economy will either stay the same as before or worsen

-Approximately 48% of all respondents believe that the economy will worsen over the next two years if Prime Minister Theresa May’s Brexit agreement is advanced

-More than 54% of all respondents believe that the economy will worsen if a “no-deal Brexit” unfolds

-Nearly 52% of all respondents believe Prime Minister Theresa May mishandled the Brexit situation

-Slightly more than 55% of all respondents are dissatisfied with how Parliament has handled the situation

Interestingly, in the event of approval of the May Brexit agreement, the highest proportion of respondents, whether “Leave” voters or otherwise, believe that the economy will be the “same as before” in the following 2 years. However, that figure drops below both the “doom and gloom” and “taking a small hit” economic scenarios forecast in the case of the “no-deal” Brexit.

Apart from highlighting the general level of frustration with public officials responsible for overseeing Brexit negotiations, the survey indicates that “Leave” voters are increasingly concerned about the economic outlook. This development might be another affirmation of the growing dissatisfaction with elected officials and the widespread discontent over the failure to reach an exit consensus.

Additionally, “Leave” voters are increasingly echoing exit concerns voiced by leading economists, with more believing that the “doom and gloom” outcome will come to fruition relative to the scenario whereby the economy is “flourishing”. Nonetheless, a comparison of the survey results with the recent performance of the UK Pound suggests that financial markets are deviating from increasingly negative public sentiment.

According to Money Transfer Comparison, this divergence might be attributable to financial markets and investors discounting the more extreme possibilities of a “hard Brexit” or “no-deal Brexit” which would align with the more polarized viewpoints underscored in the survey. Nonetheless, the survey emphasizes that public sentiment does not necessarily mirror economists’ expectations.

With all the uncertainty that remains in place ahead of the Brexit deadline, these more extreme scenarios still have a possibility of unfolding, potentially weighing on the Pound’s value despite financial markets increasingly discounting the likelihood of a disorderly EU exit.