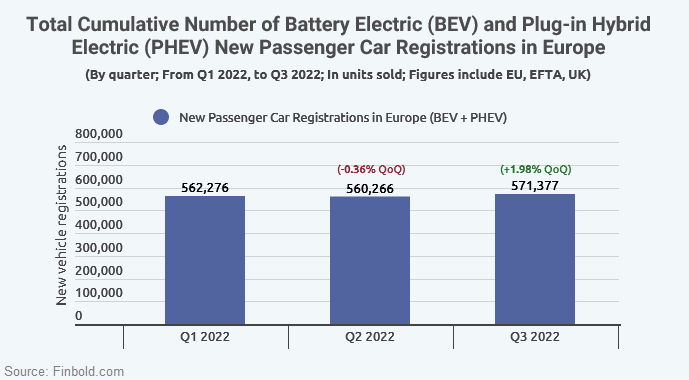

Europe’s Electric vehicle 2022 sales grow in Q3 despite economic challenges

Following a series of economic downturns, the European electric vehicle (EV) market is showing resilience despite the prevailing macroeconomic factors that have impacted consumer spending.

In particular, data acquired and calculated by Finbold on November 29 indicates that as of Q3 2022, the total number of Battery Electric (BEV) and Plug-in Hybrid Electric (PHEV) new passenger vehicles registrations in Europe stood at 571,377. The value represents a quarterly increase of about 1.98% from Q2’s value of 560,266. During Q1, the region recorded a registration of 562,276 units.

A breakdown of the car types indicates that BEVs stood at 355,336 in Q3, slightly increasing from Q2’s figure of 322,144, while in the first quarter, the registration was 325,285. Elsewhere, during the third quarter of 2022, the total registered PHEVs was 216,041, a drop from Q2’s 238,122. During Q1, the region had 236,991 new PHEV units.

Notably, the total number of new passenger car registrations across Europe with an alternative fuel type recorded a quarterly drop of 2.47% to 1,265,947 in Q3. In Q2, the cars stood at 1,297,966, representing a drop of 2.88% from Q1’s 1,336,523.

Drivers of Europe’s EV market growth

The research acknowledged that the European EV market had grown significantly while highlighting some key drivers. According to the research report:

“In general, the European EV market’s previous growth has been attributed to factors like increased income levels within a climate-conscious population, robust government support for the EV industry, and an extensive public-private partnership for EV charging infrastructure.”

Despite the growth, the EV space still faces several hurdles, with the cost factor emerging as a critical obstacle. At the same time, how the prevailing economic conditions will impact the sector is yet to be seen.