Thrifty Woman Halves Food Bill and Pays Off £16k Debt in a Year

A savvy foodie has told how she managed to HALVE her monthly food bill by ditching takeaways and top-up shops and instead preparing meals for as little as £1 per portion.

Grainne McNamee also managed to pay off £16k worth of debt in just ONE YEAR by overhauling her family’s finances and revamping their food buying habits – and she can now afford to work just two-days a week.

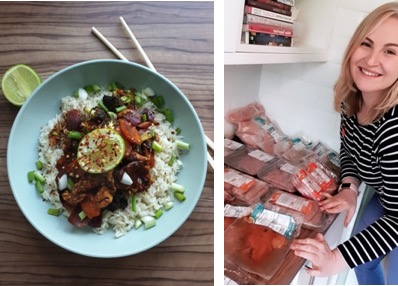

Coupling lean meat from musclefood.com with low cost vegetables, cupboard staples, and fresh spices, Grainne cooks up 45 portions of meals like chicken pie, Chinese pork ramen, and spaghetti and meatballs for less than £60.

Two years ago, Grainne and her husband Ryan were forced to reassess their finances when Ryan was dealt the devastating news that he could face redundancy from his job at a bank.

The couple had recently taken out a loan to renovate the first home they’d bought together, which, along with other smaller debts and a car loan, left them with over £16,000 of debt.

The news served as a wakeup call and business analyst Grainne realised they’d been spending frivolously and living beyond their means, so made the decision to pull their finances right back.

The pair, who live in Belfast with their dog Jessie, usually ate out or ordered takeaways once or twice a week and shopped day-to-day at various convenience shops and supermarkets the rest of the time.

As such, their food bill alone racked up to a whopping £500 each month for just the two of them.

In order to bring this cost down, 33-year-old Grainne decided to start meal planning, batch cooking, and doing a weekly food shop.

By pre-planning meals each week and using healthy meat from musclefood.com Grainne now prepares over a weeks’ worth of evening meals with leftover portions for lunches, for as little as £2.05 per meal.

Grainne said: “We were dealt a bit of a blow in 2017 when my husband faced redundancy, and it made us realise just how mindless we’d become with our spending.

“We’d recently bought a new car on finance, but it was on a complete whim. We literally walked into the car dealership and drove out in a brand-new car the same day, having signed up to what was essentially another £11,000 loan.

“This meant that each month, we were forking out over £400 in loan payments, just to meet the minimum required.

It was at this point that I made the decision to try and clear over £16k worth of debt in just 12 months – something that some friends and family thought was far too ambitious at the time.

“But I was really determined to get our finances back on track so in order to hold myself accountable I made a dedicated Instagram page, @WannaBeDebtFree, where I began logging day-to-day spending, loan payments, and our finances in general.

“It was quite intimidating to start off with because people are usually so tight lipped about anything to do with income, spending, and debt in particular, but I found a huge online community that were incredibly helpful using the hashtag #DebtFreeCommunity.

“It took a while to get Ryan on board but eventually we were able to sit down and really fine tune our spending – cancelling memberships and direct debits that weren’t absolutely essential, and changing the way we viewed money in general.

“Soon we were paying about £1000 in loan overpayments each month, and our total debt gradually reduced.”

Grainne and Ryan quickly realised that a huge chunk of their monthly income was being spent on food, particularly on takeaways and eating out.

Grainne continued: “It wasn’t until I totted up the figures that I realised we were spending around £500 a month on food alone, which is a massive amount for just two people!

“So, I set about learning how to batch cook, meal plan, and started food shopping week by week instead of day by day which is what we had been doing.

“When you’re really trying to be careful with your spending and get the absolute most for your money, Musclefood hampers are fantastic.

“The quality of the food is amazing which meant the meat went further, and they’re great value for money.

“Using chicken breast, minced beef, pork, and steak as bases, I now cook up hearty but healthy meals like Chinese pork ramen, meatball marinara and chicken katsu curry.

“And I can use any meaty leftovers to make a big meat feast pizza which feeds three for about £4.90 – which is better value than most supermarkets.

“When meal planning, I usually make a mental note of one night where we will be eating leftovers, usually just before our weekly food shop.

“This gives us an opportunity to raid the fridge of any veggies or produce that hasn’t been used. Not only does this save money it also cuts down on the level of household waste.

“Another tip would be to learn how to eat repeatedly, so eating dishes throughout the week which have similar or the same components.

“This may sound boring, but it gives you the opportunity to be really creative whilst being cost efficient as you can buy in bulk, and really make your groceries stretch further.”