The average Brit owns 33 per cent of their property when they enter into a mortgage

At the point of buying a property and officially entering into a mortgage, Brits only own the equivalent of an average-sized kitchen and bathroom, according to new research by the UK’s leading price comparison website, MoneySuperMarket1.

The study looks into how much of the average home gets “bought” over the course of the mortgage, with only 33 per cent of a house officially owned by the buyer when they complete on the purchase of the property.

With each square metre of a UK property costing an average of £3,248.16, the findings reveal that the master bedroom costs £43,400, roughly £3,000 more than the kitchen, with the living room the most valuable space, at £55,5002.

Average cost of each room

| Master Bedroom | Second Bedroom | Third Bedroom | Bathroom | Living Room | Kitchen | |

| UK Average

Cost |

£43,434.12 | £35,345.04 | £27,028.56 | £18,029.87 | £55,519.00 | £40,965.16 |

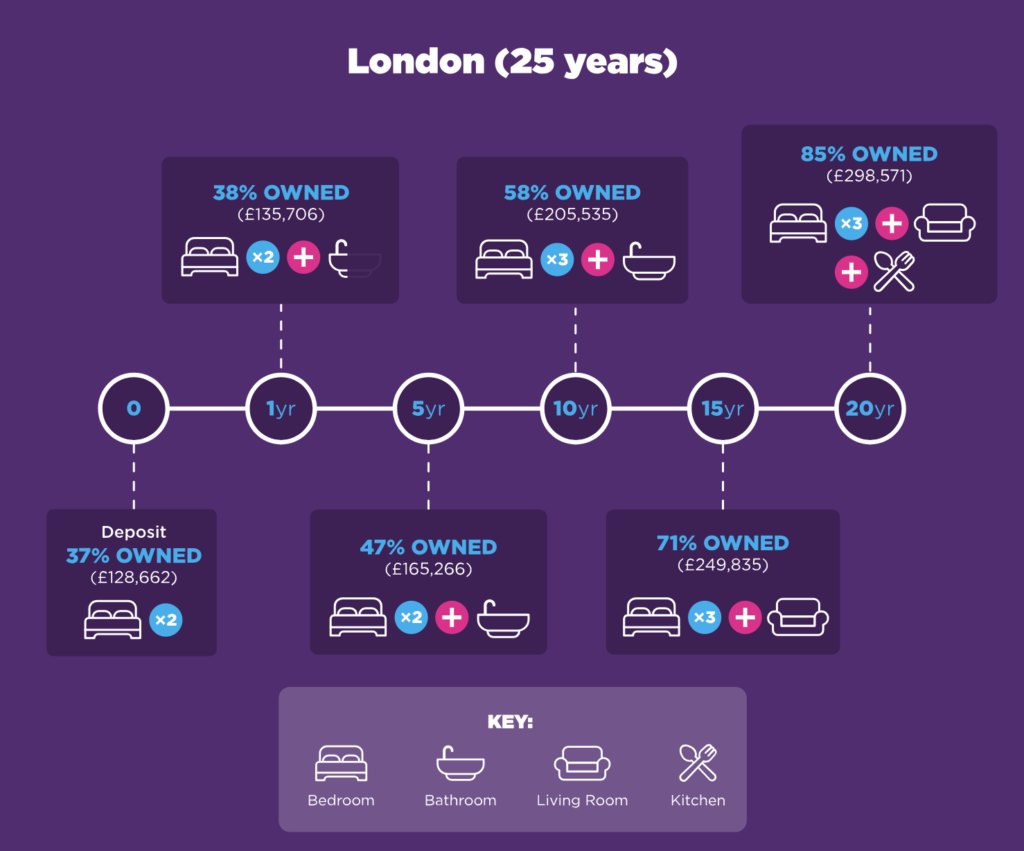

Those buying in Leeds will typically own 41 per cent of the property after five years (master bedroom, kitchen and half of living room), compared to a weighty 61 per cent in Edinburgh (master bedroom, kitchen and the entire living room). In the capital, buyers will own just under half of their property after five years (47 per cent) – amounting to a master bedroom, a second bedroom and a bathroom.

The data also brings into focus the north versus south divide when it comes to the cost of property. For example, after paying off a mortgage for five years in Plymouth, home owners would have paid off 44 per cent of the property – or the equivalent of £95,429.25. However, in Newcastle, paying off the same proportion of the property over five years would have cost over £10,000 less, coming in at £82,579 on average3.

Rachel Wait, consumer affairs spokesperson at MoneySuperMarket, commented: ”It’s increasingly difficult to get on the property ladder, yet we don’t tend to think about what that means in terms of how much of your home you actually own after you’ve spent the time saving for a deposit and going through the buying process.

“While this obviously doesn’t mean that new homeowners are restricted to half a kitchen until they’ve paid off enough of their mortgage, it does raise some interesting questions about the increasing cost of properties and how much you end up paying for a property of the same size, depending on which part of the country you’re living in.

“As always, it’s worth shopping around when taking out a mortgage to ensure you’re getting the best deal possible, and making sure payments are made on time so you don’t face costly late payment fees.”

For more information on how much of your home you actually own, visit MoneySuperMarket’s housing deficit page for more information and the full study.